- Home

- Website design

Design of high-performance and scalable websites

For us, a website isn’t just a showcase. It’s a strategic tool designed to improve your visibility, automate your processes, and maximize your conversions.

Prositeweb, your partner in tailor-made web development

For nearly 10 years, we’ve been supporting businesses in their digital transformation by designing modern, high-performance, and scalable websites. Specializing in custom development, we create platforms tailored to your business objectives: visibility, conversion, online sales, or automation. Whether you need a showcase site, eCommerce, or a more complex solution, our team implements the best technologies to offer you a fast, secure, and easy-to-manage website.

Our approach

At Prositeweb, every project begins with a clear understanding of your business objectives.

- Do you have traffic, but few customers?

- Are you spending too much time manually managing your content?

- Are your tools not communicating with each other and hampering your efficiency?

We begin by analyzing these obstacles to understand their cause. We then offer you a structured and sustainable solution.

The goal is not just to create a website, but to design a strategic tool that helps you perform better, automate your processes and support your long-term growth.

Why choose Prositeweb for your website development?

Our website design packages

Essential

$

Custom design (up to20 pages)

Mobile optimization and basic SEO

Contact form

Google Analytics integration

Website management training

No unnecessary plugins/extensions

Business

$

Custom website (up to 100 pages + dynamic modules)

Multi-user management (custom roles)

Dedicated client or partner area

API integration (CRM, ERP, marketplaces, etc.)

Advanced SEO optimization

Maintenance and support for 3 months

Comprehensive training for the entire team

Tailor-made by the hour

$

/hour

Custom module development

Performance optimization

Complex API integration

UX/UI adjustments

Business task automation

Application development

Updates and automation

What sets us apart

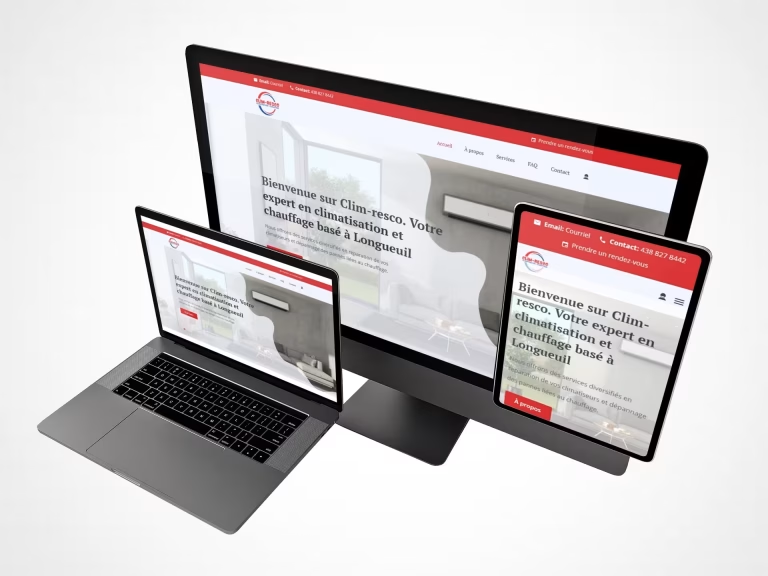

Our recent achievements

FAQ – Frequently Asked Questions

1. What programming languages do you use?

2. What CMS do you offer?

3. Can you develop custom web applications?

4. Do you offer maintenance and development services for my web projects?

5. How can I get a quote for my project?

6. What are your delivery times?

7. Do you offer guarantees?

8. Do you have any customer references?

9. How can I contact you?

2. What are the advantages and disadvantages of static websites?

Pros:

- Simplicity: Easy to create and maintain, even for beginners.

- Loading speed: Content is pre-written, so pages load quickly.

- Low hosting costs: Does not require powerful servers, making them more affordable.

- Security: Less vulnerable to hacking because the content is static.

Cons:

- Limited features: Cannot include complex user interactions or personalized content.

- Manual updates: Any changes to the content require manual editing of the HTML files.

- Poor scalability: Difficult to manage for websites with high traffic or constantly changing content.